The rising demand for programmatic advertising among advertisers is driving market growth. According to Statista, global programmatic advertising spending is expected to reach USD 724 billion by 2026. The DSP market exclusively was valued at USD 20.77 billion in 2022 and is projected to reach USD 92.12 billion by 2029. It’s important to note that this estimation does not account for potential growth fueled by new players aiming to enter the DSP advertising arena.

Players from various industries, such as retail, media and entertainment, telecommunication, and gaming, are deciding to build their own DSPs. In this blog post, we cover their main reasons for developing this AdTech platform.

Key Points

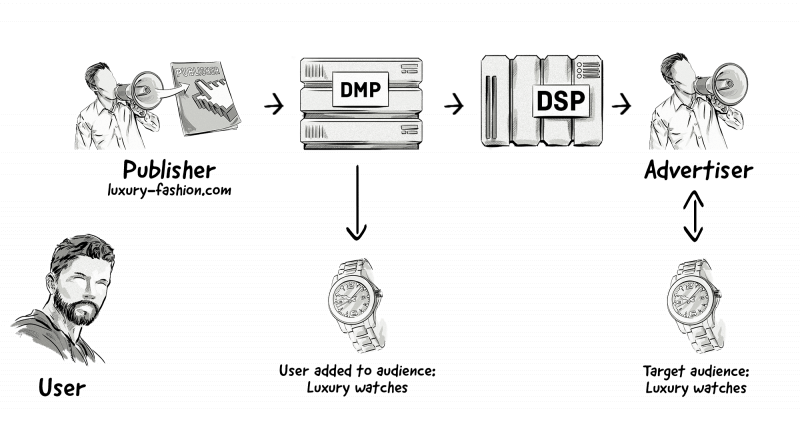

- A demand-side platform (DSP) is an AdTech platform for ad buyers (brands and ad agencies) to purchase ad inventory on an impression-by-impression basis.

- DSPs are connected to ad exchanges and supply-side platforms (SSPs) and enriched with data from data platforms like data management platforms (DMPs) and customer data platforms (CDPs).

- Advantages of DSPs include automated ad buying, scalability, cost-effectiveness, and precise audience targeting.

- Key market drivers for DSPs are the demise of third-party cookies, new and emerging digital channels, the development of new ad formats, a focus on contextual and content-driven advertising, and regulatory compliance.

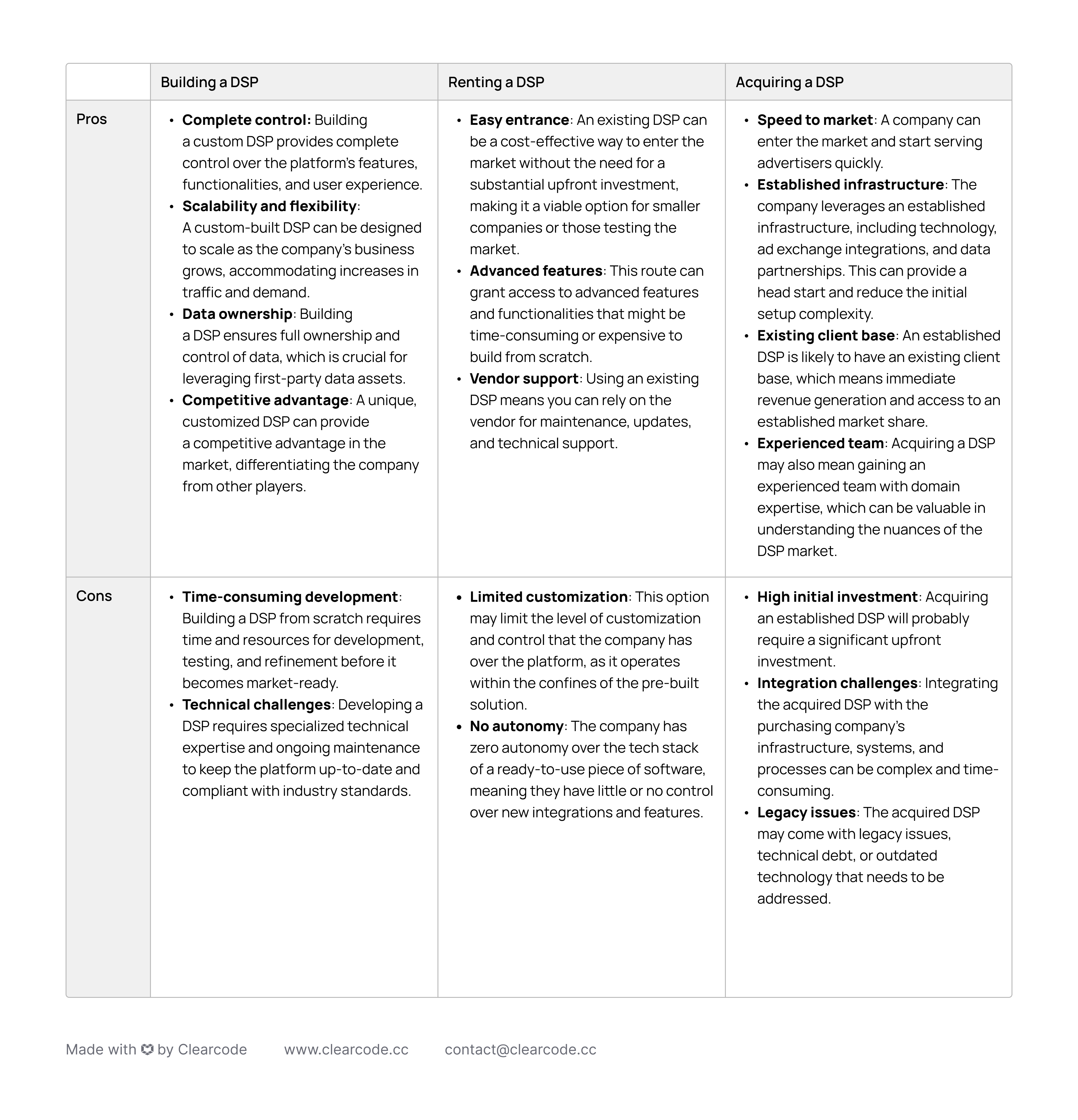

- Companies can enter the DSP market by acquiring an existing DSP, renting one, or building their own.

- Reasons companies want to build their own RTB bidder or DSP include capitalizing on first-party data assets, cutting costs on media, gaining autonomy, and addressing measurement challenges. Building a DSP also allows companies to optimize their demand path, avoid exchange bias, occupy niche verticals, and gain new clients with ad fraud detection and other security mechanisms.

- As the advertising industry experiences significant growth, companies from various industries are exploring the potential of building their own DSPs. Among new entrants, retail, telecommunications, publishing, media, and entertainment are the leading industries.

What Is a Demand-Side Platform, and What Is It For?

A demand-side platform (DSP) is an AdTech platform for ad buyers such as brands and ad agencies to purchase ad inventory on an impression-by-impression basis. The buyers can set the advertising campaigns and programmatically bid to purchase precisely targeted video ads, display ads, in-game ads, etc.

To run and complete the buying process, DSPs are connected to:

- SSPs and ad exchanges to purchase ad inventory.

- Data management platforms (DMPs) to provide a more detailed view of customers and create more personalized marketing messages.

- Customer data platforms (CDPs) to track and manage the customer journey more effectively.

The most common way DSPs buy available ad space on websites and apps is via real-time bidding (RTB). The RTB process is a live auction whereby DSPs bid on impressions offered by ad exchanges and supply-side platforms (SSPs).

The Key Functionalities of a DSP

DSPs enable brands and advertisers to streamline the procurement of ad impressions across various supply sources. By automating the process, they enhance efficiency and precision in targeting the intended audience while managing costs effectively.

Some DSPs also leverage artificial intelligence and machine learning to enhance their functionality. While not all DSPs incorporate these technologies, a subset employs AI and ML techniques to optimize ad placement and pricing. These tools analyze data patterns and user behavior to guide advertisers towards optimal ad placements, ensuring they reach individuals who are most likely to engage and convert.

In other words, DSPs facilitate the intricate task of purchasing ad impressions across diverse platforms, and when coupled with AI and ML capabilities, they can potentially elevate the accuracy and impact of advertising efforts.

For that reason, DSPs:

- Manage ad inventory: Advertisers can set up ad campaigns, buy ad inventory from various publishers, and optimize the performance of their campaigns through a single user interface.

- Track campaign performance and optimize campaigns in real time: DSPs offer advanced tracking and analytical tools, allowing advertisers to monitor ad performance, make data-driven decisions, and optimize campaigns in real time.

- Bid in real time: DSPs work in conjunction with supply-side platforms (SSPs) to enable real-time bidding across multiple ad exchanges, enhancing access to quality ad spaces.

The Key Advantages of a DSP

DSPs enable automated ad buying, thus freeing up marketers’ time and resources that were previously spent on manually negotiating with publishers.

In addition to automation, DSPs have a few other general advantages:

- Scalability: DSPs offer greater access to various forms of ad inventory because of their connections to SSPs and ad exchanges.

- Cost-effectiveness: Through real-time bidding and automated decision-making processes, DSPs can optimize costs by determining the most suitable bid for an ad in real time.

- Targeting specific audiences: With the help of data, AI, and ML, DSPs facilitate the targeting of specific audience segments across a range of publisher sites, allowing for more precise and effective advertising campaigns. For instance, targeting options may include behavioral, lifestyle, demographic, device, audience lookalikes, in-market audiences, contextual, and retargeting.

Key DSP Market Drivers

The DSP landscape is influenced by several factors — from the growing amount of first-party data to the demise of third-party cookies and strict privacy regulations.

Although these factors will have a negative impact on how DSPs have been working up until now, DSPs will need to evolve to help advertisers navigate this new world — e.g., by allowing them to utilize their first-party data for ad targeting.

Below, we explain the current major reasons behind the ever-changing market and the role DSPs can play.

The Demise of Third-Party Cookies

Although the demise of third-party cookies in web browsers is negatively impacting the DSP market and the AdTech market more broadly, there are many opportunities for existing companies to update their existing DSPs and for new entrants to enter the space to provide solutions to this challenge.

Third-party cookies have been a crucial tool for audience targeting and retargeting in digital advertising. With their phasing out due to privacy concerns and regulatory changes, advertisers are actively seeking alternative targeting solutions.

DSPs can capitalize on this need by offering sophisticated targeting capabilities that leverage first-party data and alternative identifier solutions and technologies, such as UID 2.0, FLEDGE, and Topics API.

New Ad Formats Development

Since the very first display ad in 1994, new ad formats have emerged and taken over the digital space on computers, mobile devices, audio services, and television. Wherever the audience is — in games, on TV, on retail sites, etc. — ads are sure to follow.

DSPs aim to buy ads precisely targeted at specific audiences, whether these are in-game ads, native ads, social ads, etc. And these platforms do it close to real-time. Advertisers can rely on the dynamic that DSPs give them in terms of running modern ad campaigns.

Focus on Contextual and Content-Driven Advertising

With the limitations on individual user tracking, contextual advertising is gaining importance. Contextual targeting displays ads based on the content of the web page rather than user data. DSPs that can effectively leverage contextual targeting and dynamic content optimization will likely see increased demand from advertisers who want to reach relevant audiences in a privacy-friendly manner.

Regulatory Compliance and Ad Verification

As ad environments become more complex, advertisers are increasingly concerned about brand safety and ad fraud. DSPs that offer robust ad verification tools and ensure brand-safe placements will be preferred by advertisers seeking to maintain a positive brand image and maximize campaign effectiveness.

Should Companies Build, Rent or Buy a DSP?

To enter the DSP market, a company can build a custom DSP, rent an existing one (e.g., a white-labeled DSP), or acquire a DSP vendor. Each approach has its pros and cons, but there are many advantages for companies that build their own DSPs.

Pros and Cons of Building, Renting, or Acquiring a DSP

Here is the comparison between these options.

Top DSP Companies

As said earlier, the value of the DSP market will reach USD 92.12 billion by 2029. The majority of that number will probably come from the top DSP companies that dominate the global market. Among the largest players are well-known giants such as Amazon, Facebook, and Google. However, the space in the vertical also includes smaller companies.

The Top Reasons Why Companies Want to Build Their Own RTB Bidder or DSP

The decision to construct an RTB bidder or DSP is strategic. Whether driven by cost-efficiency, technological autonomy, or market diversification, the benefits of building a bidder or DSP underscore its role as a tool for companies aiming to thrive in the digital advertising ecosystem.

For Ad Agencies

Saving on the cost of media

By far, this is the biggest reason for building a bidder or DSP — especially for ad agencies. Due to various trends and changes within the online advertising ecosystem over the past decade, the role and position of ad agencies has shifted. Before the introduction of the Internet, ad agencies were a critical component of a brand’s advertising activities, handling everything from creating the ad to delivering it to a publisher’s sales team.

But towards the late 2000s, when new AdTech companies were coming onto the scene, we witnessed something that we’d never seen before: brands were bypassing the agency and working directly with AdTech companies due to the ease of use these platforms provide.

As a result, agencies have been playing damage control, working tirelessly to reestablish the value they provide their clients. With this has come a need to cut costs.

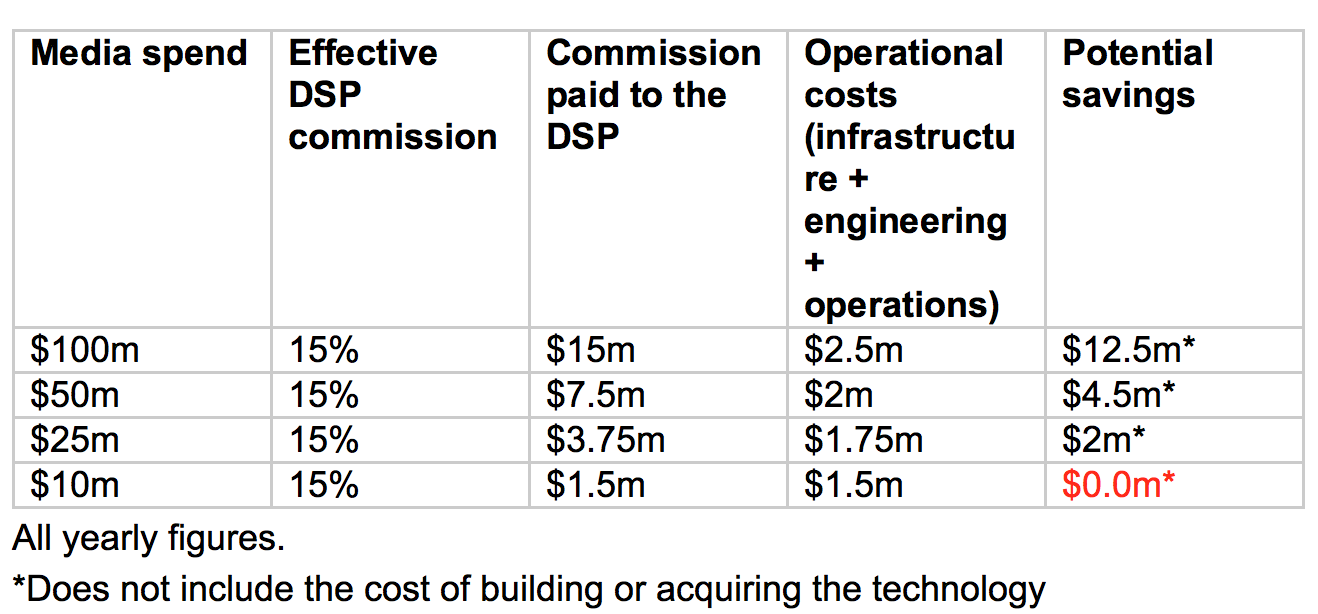

And one of the main ways agencies can cut costs is by eliminating the fees they pay to AdTech companies — demand-side platforms in particular.

Depending on the vendor, some agencies pay between 10% – 30% in commissions. On average, SSPs and DSPs collect 35% of programmatic spend. And, if an agency’s media spend is in the tens of millions of dollars per year, then there’s a significant number of dollars going to DSPs.

Control over tech stack

By building their own RTB bidder or DSP, ad agencies control the tech stack and gain autonomy. This includes the freedom to design and implement tailored features, integrations, and a strategic product roadmap. This heightened control ensures agility and adaptability, enabling the agency to respond to evolving market demands and emerging trends.

By controlling their tech stack, agencies can also avoid the limitations and uncertainties associated with third-party solutions and ensure that the platform is tailored precisely to their unique needs and preferences.

For Tech Companies

For AdTech companies, the decision to build their own DSP is more than a strategic choice — it’s often the only viable path.

Relying on an existing DSP creates potential issues around competition and relinquishes the control needed over tech stack customization, integrations, and feature development. This essential control grants AdTech companies the ability to fine-tune their offerings and align with their unique value propositions.

Expansion of product offerings

Often renowned for their innovation and technological prowess, tech companies can exponentially expand their product offerings by venturing into the realm of DSPs. A prime example is a server company delving into the creation of a DSP. This strategic expansion not only diversifies the company’s revenue streams but also leverages their existing technical expertise to enter a new market segment. By building their own DSP, tech companies can seamlessly bridge the gap between technology and advertising, providing a comprehensive solution that caters to diverse customer needs.

Benefits of Building Your Own Bidder or DSP for Advertising Operations

Optimizing Demand Path

Building a DSP allows companies to ensure transparency throughout the entire ad delivery chain, eliminating any uncertainty about where their ads are placed and who views them. This newfound transparency builds trust with customers and partners, fostering more fruitful relationships in the long run. An important part of this aspect is demand path optimization (DPO).

Avoiding Exchange Bias

Companies also strive to avoid any bias towards particular publishers or exchanges, seeking complete neutrality in their advertising operations. By building their DSP, they eliminate concerns about undue favoritism and maintain an even playing field for all stakeholders involved.

Occupying Niche Verticals

The realm of AdTech is branching into new territories, including in-game advertising, mobile ads, and streaming TV ads. As AdTech expands its reach, companies can capitalize on these specialized domains by building highly customized DSPs tailored to cater to the specific needs of each niche. This can lead to a higher return on ad spend (ROAS) for their clients.

One example of a company entering the DSP market is MarTech company Zoomd Technologies. In 2021, they built Mobile DSP to deliver mobile RTB-based campaigns across multiple ad exchanges to their clients. Among the many reasons behind their decision were mobile-oriented causes in particular.

Another example is SITO Mobile, a US-based AdTech company that allows advertisers and ad agencies to run location-targeted mobile ad campaigns via its proprietary demand-side platform (DSP).

Enhanced Security and Protection

Advertisers seek platforms that enhance their brand’s security, eliminating the threat of displaying ads in an inappropriate space. At the same time, they want to safeguard their ad budgets from the growing ad fraud phenomenon.

By incorporating protection services, anti-fraud algorithms, dedicated marketplace quality teams, exclusion and inclusion lists, sensitive site blocking, and more, companies that build their own DSP will probably win a piece of the market.

Entering The Expanding AdTech Landscape

As the advertising industry experiences a remarkable surge in global digital ad spending, with projections indicating a 10.5% year-on-year increase in 2023, reaching a staggering USD 696 billion, companies across various industries are waking up to the immense potential of building their own DSPs. The leading industries among new entrants are primarily retail, telecommunications, publishing, media, and entertainment.

The post Why Do Companies Want to Build Their Own RTB Bidder or DSP appeared first on Clearcode.

The original post is at AdTech Archives – Clearcode

Leave a Reply